Blog > Why I started an IT company in Armenia

Why I started an IT company in Armenia

Information technology Travel BusinessArmenia’s primary goal is to have a favorable environment for investors and businesses

If you work online, this would be a great choice, and I'll tell you why.

Among the many countries that offer interesting facilities for foreign investors, Armenia represents an excellent solution for those who are thinking of opening a company abroad, especially for digital nomads. I'll tell you my experience. I found myself in this country with the intention of studying the Duduk, the traditional Armenian instrument, but over the months I was lucky enough to learn about business incentives thanks to some Armenians who, invited by an US return program (aimed at contributing to the return of the Armenian diaspora to their country of origin), were in turn thinking of starting a business in their own country. Well, I immediately realized that what began as a simple study trip might have turned into a career choice with very interesting implications. I was initially very skeptical, given my lack of knowledge in terms of economics and business. But this did not demotivate me, on the contrary, I then subsequently decided to investigate the matter through an Armenian lawyer to understand something more, and actually I had the opportunity to directly see that these incentives exist, and the possibility of doing business in this country it is truly real, motivating and facilitated.

What did I do to get started?

The first thing was to find an accountant who speaks English, and I found this through my real estate agency (where I rented the house). Levon was very kind in pointing me to the right accountant for my needs. I am very grateful to him.

In turn, my accountant guided me through the opening of the company, which turned out to be extremely simple. We went to the State Register Agency of Legal Entities of Armenia and within 20 minutes I was already holding the documents certifying the opening of a Limited Liability Company (LLC) at the price of 0 dollars and there are no minimum share capitals needed... (electronic registration is also available on www.e-register.am/en/ ). In the same office you can obtain the company's seal.

After the opening of the company, I got the social number at the OVIR office in exactly 5 minutes. The social number is a useful security identifier to easily identify the taxpayer.

The third and final step was to get a bank account. This has been the longest procedure, but it's just a matter of waiting. Justified by the presence of my company, I was able to open a business account reserved for investors at one of the many Armenian banks, including Home Banking and Visa (or Mastercard) and 5 current accounts: EUR, RUB, DRAM, DOLLARS and EUR card account (the card account is actually isolated from the others and in order to use the ATM's you need to transfer from one of your accounts to the card account to add liquidity).

After that, I was ready to invoice. Now, let's move on to the point

How much taxes do I pay?

When it comes to my position as a freelance computer programmer, there are four mandatory fees for my business, 3 of them are fixed and only one is variable.

The fixed ones are:

- 23% on a fixed minimum amount of 93000 dram (around 43 dollars)

- Again on a fixed minimum of 93000 drams, the 2.5% which represents the social tax

- The fixed military tax, equivalent to 1500 dram for 2021

Finally, the only dynamic tax is 5% for IT startups that operate with foreign customers. Starting from 1 January 2020, dividends received by both resident and non-resident organisations from Armenian sources are taxed at 5%.

The total is therefore 25,000 dram per month + 5% on dividends.

This regime applies to annual revenues that do not exceed 11.5 billion drams, or around 230 thousand dollars.

You want an example? On 1000 dollars you are going to pay 100 dollars in taxes + around 35 dollars for the accountant + 2 dollars for bank's commissions.

Double taxation treaties

Armenia has double taxation treaties with 46 countries. The benefits of these treaties are easily accessible by providing supporting documentation of residency from foreign tax authorities.

Austria, Belarus, Belgium, Bulgaria, Canada, China, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Greece, Hungary, India, Indonesia, Iran, Ireland, Italy, Kazakhstan, Kuwait, Latvia, Lebanon, Lithuania, Luxembourg, Moldova, Netherlands, Poland, Qatar, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Syria, Tajikistan, Thailand, Turkmenistan, Ukraine, UAE, United Kingdom.

Questions?

If you are asking yourself the same questions I asked myself, in the meantime I could answer some of these. Am I obliged to have employees? The answer is no. What is my income? My income is directly represented by the company's dividends, which I can use at any time. Are there different taxes if I hire workers? The personal income of each employee will be taxed at 23%.

Are you an IT specialist?

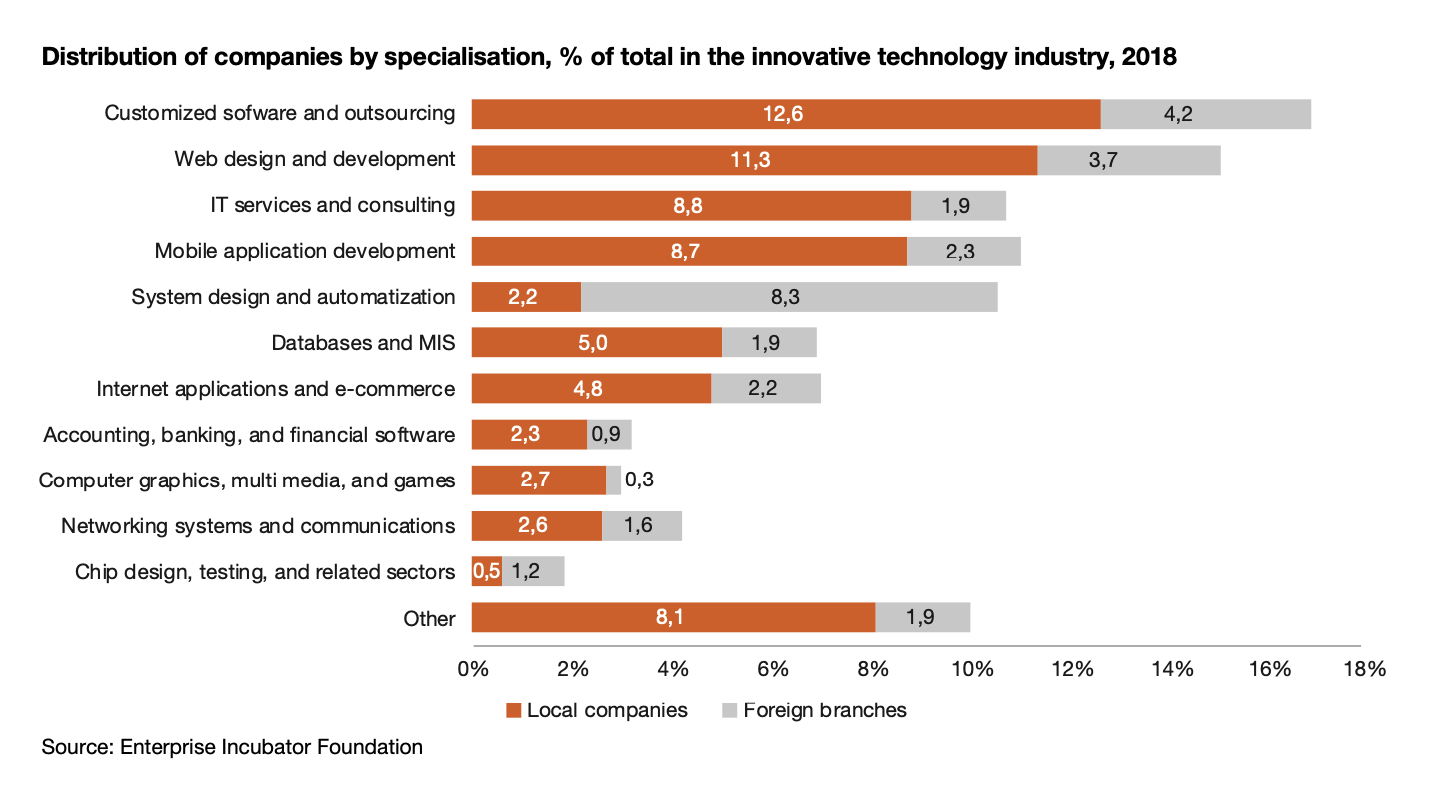

If you are an IT professional do not hesitate to deepen the subject. The incentives are real and Armenia's main goal is to create a favorable environment for investors. The IT industry is booming in Armenia and the manpower present in the country is willing and ready.